Direct Compensation Property Damage Coverage for Motorhomes in Alberta

The Government of Alberta has changed the way vehicle repairs are handled after a collision. Effective January 1, 2022, all auto insurance policies will have Direct Compensation Property Damage (DCPD) coverage. This means that it will be your insurer who pays for repairs to your motorhome if it’s involved in an accident where you’re partially at fault or not at fault.

Confused? Don’t worry. Our insurance experts will explain the change and what it means for your motorhome insurance below.

How does DCPD work for motorhomes in Alberta?

If you’re in an accident while driving your motorhome, you will open a claim with your own insurance company:

- If you’re not at fault for the accident, your insurer will cover the costs of repairing your motorhome.

- If you’re partially at fault, your insurer will partially cover the repair costs. You’ll be responsible for the rest.

- If you’re fully at fault, you have no coverage under DCPD. You’ll need collision or all-perils coverage for the repairs to be covered by your insurance.

A claims adjuster determines the fault after an accident based on the evidence provided by those involved.

As an example, let’s say you have a newer motorhome worth $85,000 on the market today. You’re involved in an accident while returning from a camping trip. Here’s how DCPD coverage would work depending on the circumstances of the collision:

- You’re not at fault: Your DCPD coverage will cover the cost of repairing your motorhome.

- You’re 25% at fault: Your DCPD coverage will cover 75% of the cost of repairs, you’ll need to cover the remaining 25%.

- You’re 75% at fault: Your DCPD coverage will cover 25% of the repair costs, you’ll need to pay for the remaining 75%.

- You’re fully at fault: Your DCPD coverage does not cover you. If you have collision or all-perils coverage, this would cover the costs of repairs. Otherwise, you’d need to pay out of your own pocket.

How does DCPD coverage affect my motorhome insurance?

You will have DCPD added to your insurance as of January 1, 2020. Your coverage is not changing, only who pays the bills for repairs after a collision.

If you’re at fault in a collision, nothing changes. You’ll need all perils or collision coverage to cover the costs of repairs. Most RV Direct Insurance policies include this coverage, but please give us a call to discuss your policy.

If you’re partially at fault or not at fault in an accident, DCPD will help cover the repair costs to your motorhome.

Will DCPD coverage affect my motorhome insurance rates?

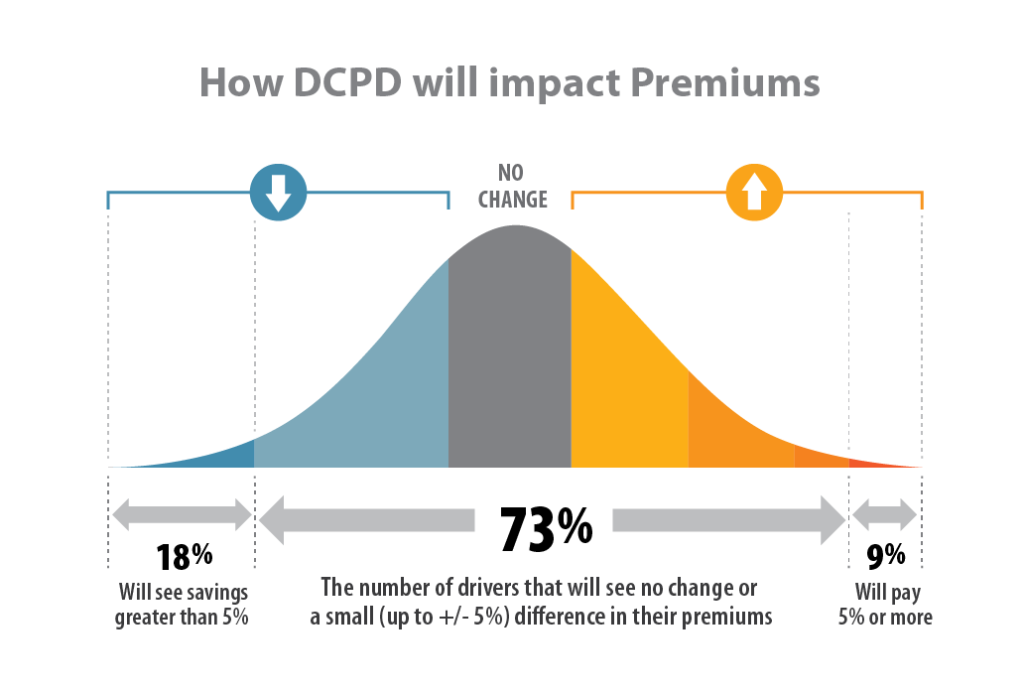

Your motorhome insurance rates may be affected by the introduction of DCPD coverage. The Insurance Bureau of Canada has a graphic that explains the impact on overall rates:

Generally, owners of motorhomes that are less expensive to repair will pay less for their insurance whereas owners of more expensive motorhomes will pay higher premiums. This is a fairer system overall.

Am I required to have DCPD coverage for my motorhome in Alberta?

Yes, DCPD is mandatory coverage for all vehicles in Alberta.

What is the deductible for DCPD coverage?

The deductible will default at $0. Some insurers may offer additional options for your deductible. Please contact us if you’d like to discuss this.

Why is Alberta adopting a DCPD system?

All other provinces in Canada already operate under a similar system. The goal is to simplify and improve the claims process, making it faster and easier for repairs to be completed. Long term, costs should be reduced.

Am I covered if the other driver doesn’t have insurance?

Unfortunately, no. If the at fault driver does not have coverage, there is no coverage under DCPD. If you have collision or all-perils coverage, this would be able to help cover the repair costs for your damaged motorhome. If you’re insured with RV Direct, you should have this coverage – talk to your broker to confirm.

What happens if someone is injured in an accident?

This section of coverage is not changing. If someone is injured in an accident, it is third party liability coverage that will respond.

Is the stuff in my motorhome covered if I’m in an accident?

DCPD covers the contents of your motorhome as well as the vehicle itself if you’re not at fault or are partially at fault in an accident. If you have a policy with RV Direct, your contents would also be covered if the other driver doesn’t have insurance or you’re at fault as our policies are comprehensive and include all-perils or collision coverage.

Do I need to do anything to get DCPD coverage?

Nope, it will be automatically added to your policy on January 1, 2022 (even if your renewal date is later). No action is required.

If you have any more questions, please give us a call or email us. We’re happy to explain this new coverage and how it affects motorhome insurance in Alberta.